Most policies (81%), however, are not subsidized. Subsidies, or flood insurance discounts, are also being phased out. Only 5% of policyholders will see this increase immediately. Upon policy renewal, premiums have the potential to increase 25% a year until full-risk rates are reached. IF YOUR PROPERTY REMAINS WITHIN THE SFHA, you may notice changes to your current insurance policy. The City expects this percentage to grow with these map changes.

More than 25% of flood claims are made by property owners located outside the SFHA. The City of Baltimore strongly recommends that property owners take advantage of lower flood insurance rates and retain their policies. The outcome of this in-depth analysis indicates that these areas are still considered to be high-risk.

In 2013, the Disaster Preparedness Project and Plan (DP3) modeled these predicted climate scenarios. It’s important to note, however, that new maps do not consider the likelihood of more extreme and unpredictable impacts related to climate change. Rate changes take place when Baltimore’s new FIRMs are adopted.

#Google earth flood maps full

Phasing-out of both grandfathering and the Preferred Risk Eligibility Extension will begin in 2014 and rates are anticipated to rise 20% per year over a 5-year period until they reach full risk rates.įOR PROPERTIES REMOVED FROM THE SFHA, policyholders will see significant decreases in flood insurance rates. Routine rate revisions will also include a 5% assessment to build a catastrophic reserve fund. To help property owners with this adjustment, Baltimore is in the process of becoming a Community Rating System (CRS) community.īeginning October 2013, premiums for pre-FIRM business properties, severe repetitive loss properties (1–4 residences), and properties on which claims payments exceed fair market value will increase by 25% annually until they reflect the full-risk rate. Some property owners will see their rates increase, while others will find that their premiums are significantly lower. This significant revision will affect many property owners in Baltimore City. The new FIRMs will impact flood insurance policies so that rates more accurately reflect flood risks.

#Google earth flood maps update

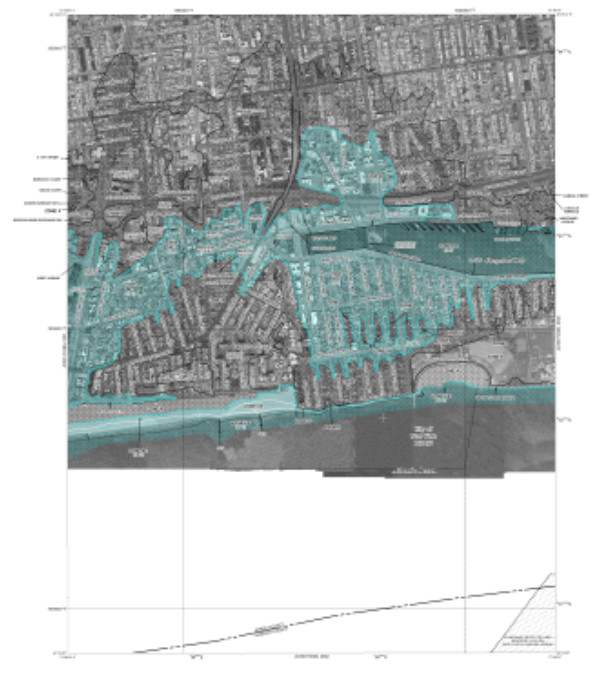

This new law mandated Baltimore’s systematic effort to update the City’s Flood Insurance Rate Maps (FIRMs) according to FEMA’s review of existing Special Flood Hazard Areas (SFHA). To strengthen the NFIP financially, Section 100205 of the new law requires FEMA to begin charging rates that reflect true flood risk artificially low rates and deep subsidies are no longer sustainable. Congress passed the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12), which calls on FEMA to make a number of changes to the way the NFIP operates. In addition to this upgrade, the City also updated and adopted its non-tidal floodplain maps, which will assist with both mitigation and adaptation efforts. In 2012, the City digitized its floodplain maps, which now allow for the integration of floodplain information with existing geographic information systems (GIS) resources. Biker in Baltimore after Hurricane Isabel. FEMA uses the best available technical data to create the flood hazard maps that outline your community’s different flood risk areas.įor more information about FEMA’s Flood Hazard Mapping click here. FIRMs include statistical information such as data for river flow, storm tides, hydrologic/hydraulic analyses, and rainfall and topographic surveys. FEMA maintains and updates data through Flood Insurance Rate Maps (FIRMs) and risk assessments. Through its Flood Hazard Mapping Program, the Federal Emergency Management Agency (FEMA) identifies flood hazards, assesses flood risks, and partners with states and communities to provide accurate flood hazard and risk data that will guide mitigation actions. Flood hazard mapping is an important part of the National Flood Insurance Program (NFIP), as it is the basis of the NFIP regulations and flood insurance requirements. New Coastal Flood Risk Webpages and Email List.Google Maps and FEMA Flood Maps-Connected!.

0 kommentar(er)

0 kommentar(er)